Self managed superannuation funds (SMSFs) can borrow funds to acquire assets, provided the borrowing satisfies certain requirements outlined in the Superannuation Industry (Supervision) Act 1993. This can be an attractive option for SMSF trustees for a range of reasons.

In this factsheet, we look at the limited recourse borrowing arrangements that can be used by SMSFs to invest in an asset, particularly real property.

Limited recourse borrowing arrangements

While the Superannuation Industry (Supervision) Act contains a general prohibition against borrowing, SMSF trustees have been able to borrow to acquire assets since September 2007. The Act was further amended in July 2010 with the introduction of new legislation that clarified the intended operation of the borrowing exemption.

SMSFs may borrow funds to acquire an asset provided the following conditions are satisfied:

- Single acquirable asset: The borrowed funds are used to acquire a single asset or a collection of identical assets that have the same market value (which are together treated as a single asset), which the fund would otherwise be permitted to acquire. A single asset could be a parcel of, for example, 100 BHP Billiton shares, but a parcel of 50 BHP Billiton shares and 50 Rio Tinto shares would not be considered a single asset.

- Restriction on improvements: The borrowed funds are not to be used to improve the acquirable asset. The ATO recently confirmed its position in relation to repairs vs improvements of an asset acquired through a limited recourse borrowing arrangement in Self Managed Superannuation Funds Ruling SMSFR 2012/1. Borrowed funds can be used to fund repairs and maintenance of an acquired asset, but cannot be used to improve an asset. For example, if a fire damages part of a kitchen (eg the cooktop, benches, walls and the ceiling), the SMSF trustee could use the borrowed funds to restore or replace the damaged part of the kitchen with modern equivalent materials or appliances, but it could not use the borrowed funds to extend the size of the kitchen (as this would be an improvement).

- Beneficial ownership: The acquired asset must be held on a trust where the super fund holds the beneficial interest in the acquired asset.

- Legal ownership: After acquiring the beneficial interest, the super fund has the right to acquire the legal ownership of the asset by making one or more payments to the lender.

- Rights of lender on default: If there is a default on the borrowing, the rights of the lender or any other person under the arrangement must be limited to rights relating to the acquired asset. In other words, the lender’s rights are limited to repossessing and disposing of the asset to recover funds. The lender cannot recover funds from the superannuation fund’s other assets or undertakings.

- Restriction on charge: The acquired asset must not be subject to any other charge, other than the charge that may be provided in relation to the borrowing by the SMSF trustee.

- Restriction on replacement assets: The acquired asset can be replaced by another acquirable asset (but only in very limited circumstances).

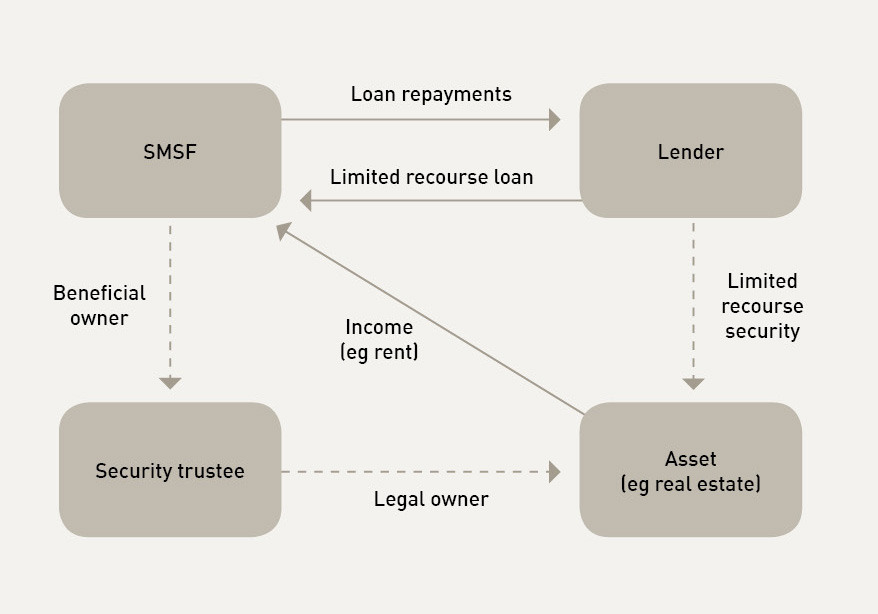

The borrowing structure

This diagram shows a typical limited recourse borrowing structure.

Funding options

There are two main funding options available:

- Third party lending: Most of the major banks, and some smaller institutions, have funding packages specifically tailored to meet the requirements of the Act.

- Self-funding: The Act does not require the lender to be an independent third party or financial institution. Members may choose to loan funds to their superannuation fund from another entity within the family group, and in doing so, will avoid the costs of borrowing from a bank.

To avoid any adverse tax consequences, clients choosing self-funding should ensure their loan to the superannuation fund is properly documented and meets the requirements of the Act. For example, the trustee of the SMSF must ensure that all investments are conducted on an arm’s length basis. This means that a SMSF trustee cannot allow a related party to charge the fund more or less than an arm’s length rate of interest under the borrowing arrangement.

The ATO have published Practical Compliance Guidelines PCG 2016/5 which provides safe harbour requirements to ensure a related party loan is an arm's length dealing.

Types of assets that can be acquired

A SMSF can only borrow money to acquire an asset if it would not be prohibited from investing in that asset directly. For example, a superannuation fund is prohibited (subject to certain exceptions) from intentionally acquiring an asset from a related party of the fund. One of the exceptions to this rule is where the asset is business real property and it is acquired for market value. Business real property is any freehold or leasehold interest in real property where the real property is used wholly and exclusively in one or more businesses.

Therefore, a SMSF could, for example, acquire commercial property that is used to operate a business from a related party, but could not, for example, acquire a related party’s residential premises.

Other considerations

Before entering into a limited recourse borrowing arrangement, a SMSF trustee should:

- review the fund’s trust deed to ensure it contains the appropriate provisions to allow the trustee to borrow funds to acquire the asset, to create a charge over the acquired asset, and to appoint a custodian to hold legal title to the acquired asset;

- review the fund’s investment strategy to confirm whether it allows the SMSF trustee to borrow funds to acquire the asset;

- consider the quality of the investment and whether the SMSF can meet all future obligations, including, for example, rates, land tax (if applicable), interest and loan repayments, repairs and maintenance costs; and

- seek independent professional advice to ensure that the investment complies with the law, because there are severe penalties that can apply if the trustee gets it wrong.

How we can help

HopgoodGanim Lawyers' legal experts can advise on all matters relevant to SMSF borrowing arrangements, including:

- reviewing existing self managed superannuation fund deeds;

- establishing new self managed superannuation funds;

- establishing SMSF borrowing arrangements for either third party funding or self-funding;

- preparing SMSF bare trust deeds;

- providing advice on the stamp duty relevant to the ultimate transfer of the asset from the bare trust to the SMSF;

- drafting loan and security documentation for clients who wish to self-fund; and

- preparing co-ownership deeds, which allow two superannuation funds to acquire a property as tenants in common.

For more information on investing in real property through your SMSF or to discuss your SMSF generally, please contact our Superannuation team.