Major reform has been reported for the Australian Securities and Investments Commission (ASIC), with the commission said to be consolidating its enforcement arms. In this alert, Partner and Head of Digital Assets Tim Edwards and Solicitor Tom Mirolo-Lynam discuss what the reform might mean for participants in the Australian digital asset industry.

The restructure

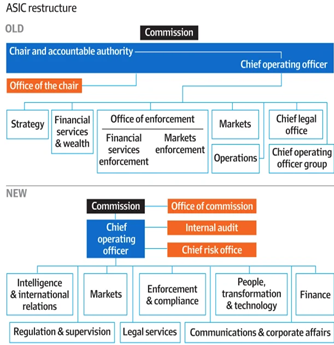

This week it has been reported that ASIC intends to effectively merge its two existing enforcement arms (being its financial services enforcement and markets enforcement arms respectively) into one overarching enforcement division.

It is expected the new division will prioritise the taking of legal action against those who breach Australia’s corporation laws and financial regulations. The intended result will be a “less siloed-approach to enforcement” according to current ASIC Chairman, Joe Longo.

A diagram summarising the restructure, sourced from ASIC, is set out below.

Source: ASIC.

Why?

ASIC has been hammered, perhaps sometimes unfairly, by serious criticism in recent years. It has been subjected to in-house investigations and public enquiries, critiqued during the course of the Royal Banking Commission, and managed to acquire a poor track record in Court. The common thread, throughout those criticisms, is that the commission appears under-resourced and inconsistent in some of its approaches.

The unification of ASIC’s enforcement arms seems to be a considered attempt to best use what resources ASIC has and reduce the likelihood of matters falling between the two enforcement arms; though it remains to be seen whether those resources will be enough or used efficiently.

The changes may also be an extension of the increasingly aggressive and precedent-hungry approach exhibited by ASIC in the digital asset space seen in recent months. The Block Earner litigation is a good example, in our view, of ASIC becoming frustrated with slow legislative reform. It may be that the reforms are intended to better align the body’s structure with that aggressive, precedent-hungry approach.

If that is so, the reform and this emerging attitude will be reminiscent of the well-trodden and all too familiar path of the American SEC. Indeed, on 11 April 2022, the SEC issued its Staff Accounting Bulletin No. 121 which, amongst other things, noted that the lack of legal precedent and regulatory protections (in the United States of America) meant that the treatment of arrangements between customers and crypto platforms would be decided by court proceedings.

If participants in Australia’s digital asset industry truly seek greater certainty as to how outdated laws apply to them, it would only be a good thing, at a macro level, that Australia’s corporate watchdog is sick of waiting for the legislature to throw it a bone.

Practical implications for the next 12 months

But what does this sort of reform mean, in practice over the next 12 months, for Australia’s digital asset industry?

Well, ASIC seems to be taking steps which may well be designed to better resource enforcement action. Thus, it would make sense to expect that it will take more enforcement action in the near future than it has previously. More notices might be issued, more investigations might be started, and more litigation may be commenced. Greater certainty may be coming, but participants in the industry can probably expect to see more of their local regulator in the coming months than they otherwise would have.

If ASIC engages with you, that may not necessarily be a bad thing, though it is critical that you understand what ASIC wants, how you are obliged to cooperate and of course, seek appropriate advice in any event.

HopgoodGanim Lawyers has an experienced Digital Asset practice group which includes experts in financial regulation as well as litigation, dispute resolution and investigations. They have experience engaging with ASIC and resolving disputes or litigation involving digital assets generally. Please contact Tim Edwards, Partner and Head of our Digital Assets practice, if you have an enquiry.